Mid Hudson Valley Federal Credit Union (FCU) is a leading financial institution that serves the Hudson Valley region with exceptional banking services tailored to its members' needs. As one of the most reputable credit unions in the area, Mid Hudson Valley FCU has built a solid reputation for providing personalized banking solutions, competitive rates, and a commitment to community development. Whether you're looking for savings accounts, loans, or investment opportunities, this credit union offers everything you need to achieve your financial goals.

Established with the mission of empowering individuals and families financially, Mid Hudson Valley FCU stands out as a member-focused organization. Unlike traditional banks, credit unions like Mid Hudson Valley FCU operate on a not-for-profit basis, ensuring that profits are reinvested into the community and returned to members in the form of better rates, lower fees, and enhanced services.

As we delve deeper into this article, you'll discover the many advantages of becoming a member of Mid Hudson Valley FCU. From its wide array of financial products to its dedication to customer satisfaction, this credit union is committed to helping you build a brighter financial future. Let's explore what makes Mid Hudson Valley FCU a top choice for residents of the Hudson Valley region.

Read also:Brookhaven Funeral Home A Compassionate Guide To Celebrating Life And Honoring Memories

Table of Contents

- About Mid Hudson Valley FCU

- Membership Benefits

- Savings Accounts

- Loan Products

- Mortgage Services

- Investment Opportunities

- Digital Banking Solutions

- Community Involvement

- Security Measures

- Frequently Asked Questions

About Mid Hudson Valley FCU

Founded in [Year], Mid Hudson Valley FCU has grown to become one of the most respected financial institutions in the Hudson Valley region. With a focus on serving its members' financial needs, the credit union has expanded its services to include a wide range of products designed to meet the diverse requirements of its community.

History and Growth

From humble beginnings, Mid Hudson Valley FCU has evolved into a robust financial institution. Over the years, it has consistently adapted to changing market conditions while maintaining its core values of integrity, transparency, and member service. Today, the credit union serves thousands of members across the region, offering personalized solutions to help them achieve their financial dreams.

Mission and Vision

The mission of Mid Hudson Valley FCU is to provide exceptional financial services that empower its members to achieve financial stability and success. The vision is to be the go-to financial partner for individuals and families in the Hudson Valley, offering innovative solutions and fostering a sense of community.

Membership Benefits

Joining Mid Hudson Valley FCU comes with numerous benefits that make it an attractive option for anyone seeking a reliable financial partner. Below are some of the key advantages of becoming a member:

- Competitive interest rates on savings and loans

- No hidden fees or charges

- Access to a wide range of financial products

- Personalized customer service

- Community-focused initiatives

Members enjoy a level of service that prioritizes their financial well-being and offers solutions tailored to their unique needs.

Savings Accounts

Mid Hudson Valley FCU offers a variety of savings account options designed to help members grow their wealth over time. These accounts are structured to provide competitive interest rates while maintaining flexibility and accessibility.

Read also:Aberdeen Livestock A Comprehensive Guide To Understanding Its Role In Agriculture

Types of Savings Accounts

Some of the savings account options available at Mid Hudson Valley FCU include:

- Basic Savings Accounts

- Money Market Accounts

- certificates of deposit (CDs)

Each account type is designed to cater to different saving goals and preferences, ensuring that members can find the perfect fit for their financial strategy.

Loan Products

Mid Hudson Valley FCU provides a comprehensive suite of loan products to help members finance their dreams, whether it's purchasing a home, buying a car, or consolidating debt. These loans are offered at competitive rates with flexible repayment terms.

Popular Loan Options

Here are some of the most popular loan products offered by Mid Hudson Valley FCU:

- Personal Loans

- Auto Loans

- Home Equity Loans

With a focus on affordability and accessibility, these loans make it easier for members to achieve their financial goals without compromising their budgets.

Mortgage Services

For those looking to purchase or refinance a home, Mid Hudson Valley FCU offers a range of mortgage services designed to simplify the home-buying process. These services include competitive mortgage rates, expert guidance, and personalized support every step of the way.

Key Features of Mortgage Services

Some of the standout features of Mid Hudson Valley FCU's mortgage services include:

- Fixed and adjustable-rate mortgages

- First-time homebuyer programs

- Refinancing options

By partnering with Mid Hudson Valley FCU, homebuyers can secure the financing they need to make their dream homes a reality.

Investment Opportunities

Mid Hudson Valley FCU also offers investment opportunities to help members grow their wealth over the long term. These investments are designed to align with members' risk tolerance and financial goals, ensuring a tailored approach to wealth management.

Investment Products

Some of the investment products available through Mid Hudson Valley FCU include:

- Retirement Accounts (IRAs)

- Mutual Funds

- Stock and Bond Portfolios

With expert advice and a wide range of options, members can build a diversified investment portfolio that supports their financial future.

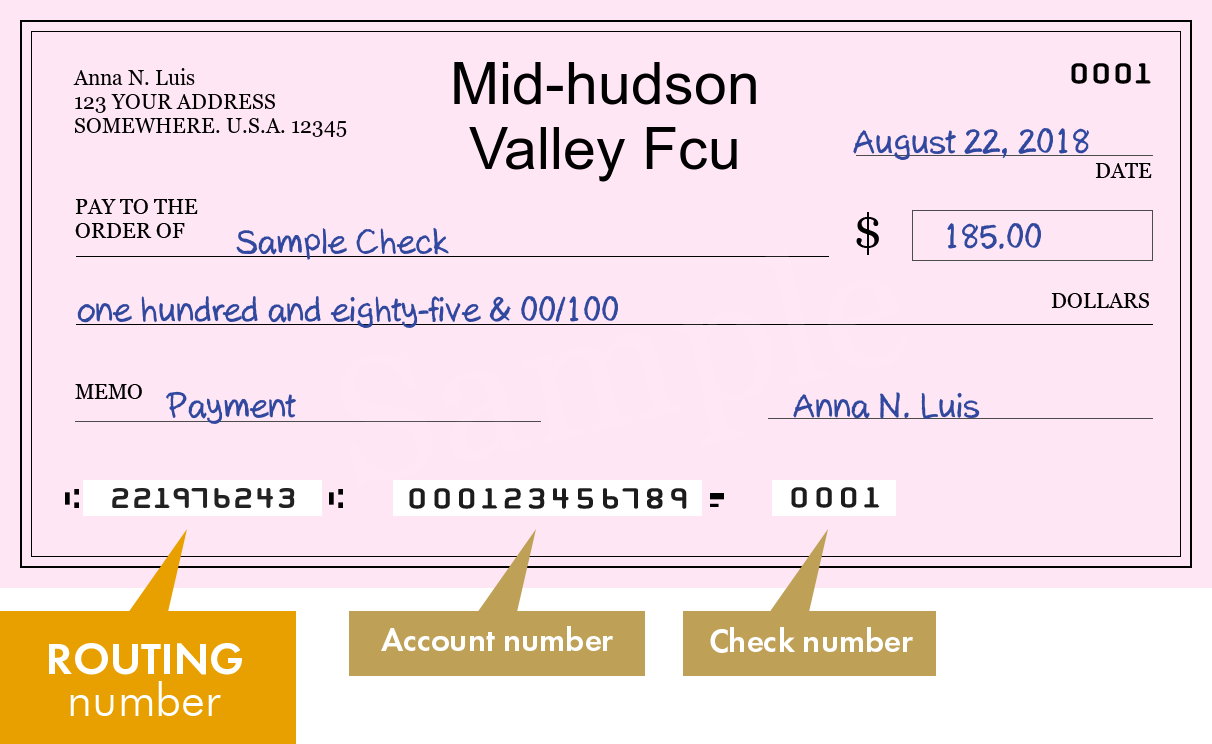

Digital Banking Solutions

In today's digital age, convenience is key. Mid Hudson Valley FCU offers cutting-edge digital banking solutions that allow members to manage their finances from anywhere at any time. These solutions include mobile banking apps, online bill pay, and secure account access.

Benefits of Digital Banking

Some of the benefits of using Mid Hudson Valley FCU's digital banking services include:

- 24/7 account access

- Real-time transaction monitoring

- Mobile check deposit

By embracing technology, Mid Hudson Valley FCU ensures that its members have the tools they need to stay on top of their finances.

Community Involvement

Mid Hudson Valley FCU is deeply committed to giving back to the community it serves. Through various initiatives and partnerships, the credit union supports local organizations, charities, and events that enhance the quality of life in the Hudson Valley region.

Community Programs

Some of the community programs supported by Mid Hudson Valley FCU include:

- Financial literacy workshops

- Local school partnerships

- Charitable donations and sponsorships

By investing in the community, Mid Hudson Valley FCU reinforces its commitment to making a positive impact in the lives of its members and neighbors.

Security Measures

At Mid Hudson Valley FCU, security is a top priority. The credit union employs advanced security measures to protect members' personal and financial information, ensuring peace of mind when conducting transactions.

Security Features

Some of the security features implemented by Mid Hudson Valley FCU include:

- Two-factor authentication

- Encryption technology

- Fraud monitoring and alerts

These measures help safeguard members' accounts and prevent unauthorized access, maintaining the trust that Mid Hudson Valley FCU has built over the years.

Frequently Asked Questions

Here are some common questions about Mid Hudson Valley FCU:

How do I become a member?

To become a member of Mid Hudson Valley FCU, simply visit one of their branches or apply online. Membership is open to residents of the Hudson Valley region who meet eligibility requirements.

What are the membership fees?

Mid Hudson Valley FCU does not charge membership fees. Instead, members are required to open a savings account with a minimum deposit.

Can I access my account online?

Yes, Mid Hudson Valley FCU offers robust online and mobile banking services, allowing members to access their accounts anytime, anywhere.

Conclusion

Mid Hudson Valley FCU is more than just a financial institution; it's a trusted partner in achieving financial success. With a wide array of products and services, a commitment to community involvement, and advanced security measures, this credit union offers everything you need to build a secure financial future.

We invite you to take the next step by joining Mid Hudson Valley FCU today. Whether you're looking to open a savings account, apply for a loan, or invest in your future, this credit union has the tools and expertise to help you succeed. Don't hesitate to leave a comment, share this article, or explore other resources on our website to learn more about the benefits of becoming a member.