Colorado Department of Revenue News is an essential topic for residents and businesses in the state. It covers a wide range of updates related to taxes, licenses, and other revenue-related matters. Whether you're a business owner, taxpayer, or simply someone interested in staying informed, this article will provide you with comprehensive insights into the latest developments.

The Colorado Department of Revenue (CDOR) plays a crucial role in managing financial regulations and ensuring compliance across the state. From tax policies to licensing procedures, the department is at the forefront of implementing measures that impact both individuals and businesses. Keeping up with Colorado Department of Revenue news ensures that you remain updated on changes that could affect your financial obligations.

In this article, we will delve into the latest updates, explore key aspects of the department's functions, and provide actionable insights for taxpayers and businesses. Whether you're seeking information about tax deadlines, license renewals, or other revenue-related matters, this guide is designed to be your go-to resource.

Read also:Decatur Dairy Your Ultimate Guide To Fresh And Local Dairy Products

Table of Contents

- Introduction to Colorado Department of Revenue

- Latest Colorado Department of Revenue News

- Tax Updates and Changes

- Licensing and Registration

- Funding and Grants

- Compliance and Penalties

- Resources for Taxpayers

- Frequently Asked Questions

- Expertise and Authority in Revenue Management

- Conclusion

Introduction to Colorado Department of Revenue

The Colorado Department of Revenue (CDOR) is a state agency responsible for administering and enforcing tax laws, motor vehicle regulations, and various other financial matters. Established to ensure fairness and transparency in revenue collection, the department plays a vital role in shaping the economic landscape of Colorado.

History and Evolution

Since its inception, the CDOR has undergone several transformations to adapt to the changing needs of the state. From implementing digital systems for tax filing to enhancing customer service, the department continues to evolve to meet modern demands.

Mission and Vision

The mission of the Colorado Department of Revenue is to promote economic growth by ensuring equitable tax policies and efficient revenue management. Their vision focuses on fostering trust and cooperation between the department and the public.

Latest Colorado Department of Revenue News

Staying informed about the latest Colorado Department of Revenue news is crucial for all stakeholders. Recent updates include changes in tax policies, new initiatives, and important announcements that affect residents and businesses alike.

Tax Policy Changes

One of the most significant updates involves adjustments to state tax policies aimed at supporting small businesses and reducing the burden on taxpayers. These changes reflect the department's commitment to economic recovery and growth.

Motor Vehicle Regulations

There have also been updates regarding motor vehicle regulations, including new requirements for vehicle registration and emissions testing. These changes aim to improve safety and environmental standards across the state.

Read also:Discover The Allure Of North Rose Hill A Premier Neighborhood In Seattle

Tax Updates and Changes

Taxation is a critical aspect of the Colorado Department of Revenue's responsibilities. Understanding the latest tax updates can help individuals and businesses plan their finances more effectively.

Income Tax Adjustments

- Income tax rates have been revised to reflect inflation and economic growth.

- New deductions and credits have been introduced to benefit specific groups, such as low-income families and veterans.

Sales Tax Modifications

- Sales tax rates have been adjusted in certain counties to align with local economic conditions.

- Exemptions have been expanded for essential goods and services.

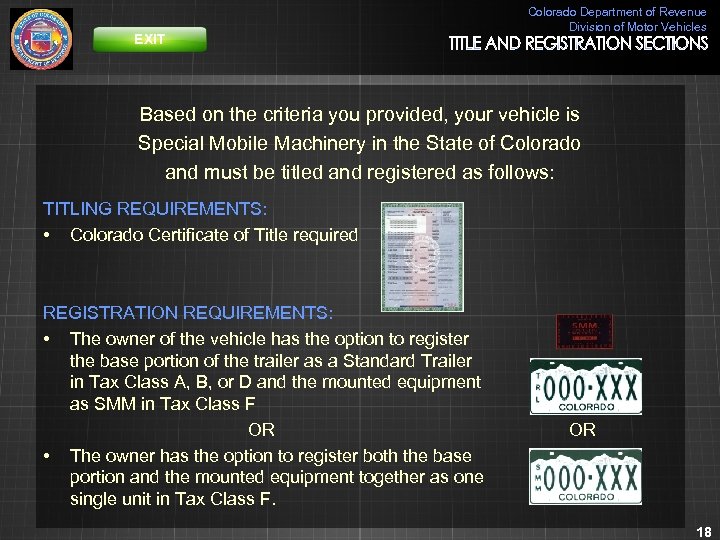

Licensing and Registration

Licensing and registration are essential components of the CDOR's operations. From business licenses to vehicle registrations, the department provides streamlined processes to make these tasks easier for residents.

Business Licensing

Business owners can now apply for licenses online, reducing the time and effort required. The department has also introduced new categories of licenses to accommodate emerging industries.

Vehicle Registration

Vehicle registration processes have been simplified through the introduction of digital platforms. Residents can now renew their vehicle registrations online, saving time and resources.

Funding and Grants

The Colorado Department of Revenue manages various funding programs and grants to support economic development and community initiatives. These programs aim to empower businesses and individuals by providing financial assistance.

Small Business Grants

Small business owners can apply for grants designed to help them grow and expand their operations. These grants focus on sectors such as technology, agriculture, and renewable energy.

Community Development Funds

Community development funds are available to support projects that enhance local infrastructure and improve quality of life. These funds are allocated based on specific criteria to ensure maximum impact.

Compliance and Penalties

Ensuring compliance with revenue regulations is a priority for the Colorado Department of Revenue. Non-compliance can result in penalties, making it essential for individuals and businesses to stay informed about their obligations.

Audit Procedures

The department conducts regular audits to verify compliance with tax laws and regulations. Businesses and individuals selected for audits are provided with clear guidelines and support throughout the process.

Penalty Structure

Penalties for non-compliance vary depending on the severity of the offense. The department emphasizes education and support to help taxpayers avoid penalties and maintain compliance.

Resources for Taxpayers

The Colorado Department of Revenue offers a range of resources to assist taxpayers in understanding and fulfilling their obligations. These resources include online tools, guides, and customer service support.

Online Tools

Taxpayers can access various online tools, such as tax calculators and filing platforms, to simplify their financial management. These tools are designed to be user-friendly and accessible to all.

Customer Support

The department provides comprehensive customer support through phone, email, and in-person assistance. Taxpayers can seek guidance on any matter related to revenue regulations and procedures.

Frequently Asked Questions

Here are some common questions and answers about the Colorado Department of Revenue:

- What are the current income tax rates in Colorado?

- How can I apply for a business license online?

- What are the penalties for late tax payments?

Expertise and Authority in Revenue Management

The Colorado Department of Revenue is recognized for its expertise and authority in managing revenue-related matters. The department employs highly qualified professionals who are dedicated to ensuring fairness and transparency in all operations.

Professional Development

Staff members undergo continuous training and development programs to stay updated on the latest trends and technologies in revenue management. This commitment to professional growth enhances the department's ability to serve the public effectively.

Partnerships and Collaborations

The department collaborates with various organizations and stakeholders to promote economic development and financial literacy. These partnerships strengthen the department's capacity to deliver high-quality services.

Conclusion

In conclusion, staying informed about Colorado Department of Revenue news is essential for all residents and businesses in the state. From tax updates to licensing procedures, the department plays a critical role in shaping the economic landscape of Colorado. By utilizing the resources and tools provided by the CDOR, individuals and businesses can ensure compliance and take advantage of available opportunities.

We encourage you to share this article with others who may find it useful. If you have any questions or comments, please feel free to leave them below. For more information on revenue-related matters, explore our other articles and resources.

Data and statistics in this article are sourced from official Colorado Department of Revenue publications and reports. For the most accurate and up-to-date information, visit the official CDOR website.