Elon Musk's idea to bring blockchain technology into treasury operations has set off a fiery debate among financial experts and tech enthusiasts alike. As one of the most influential innovators of our time, Musk’s proposals often grab global attention—and this one is no different. By suggesting the use of blockchain for managing financial reserves, Musk aims to revolutionize how governments and corporations handle their money. While the concept holds exciting potential, it also brings up some serious concerns about practicality, security, and regulatory hurdles.

This article takes a deep dive into Musk's blockchain treasury proposal, unpacking the criticisms it’s faced, its possible impact on financial systems, and the broader implications for blockchain adoption. We’ll explore both the advantages and challenges tied to this bold initiative. By the end, you’ll have a clearer picture of what this proposal means, what critics are saying, and where blockchain might fit in the future of treasury management. Whether you're a tech junkie, a finance pro, or just curious about how blockchain could shake things up, this article is for you.

Table of Contents

- Overview of Musk's Blockchain Treasury Proposal

- Elon Musk: A Quick Look at His Story

- The Nitty-Gritty of the Proposal

- What Critics Are Saying About the Plan

- Regulatory Hurdles and Concerns

- Why Blockchain Could Be a Game-Changer

- Security and Privacy: What’s at Stake?

- How Far Have We Come with Blockchain in Finance?

- Blockchain vs. Traditional Systems: Who Wins?

- What Does the Future Hold?

Overview of Musk's Blockchain Treasury Proposal

Elon Musk’s proposal to integrate blockchain into treasury management is nothing short of ambitious. The plan envisions a future where governments and corporations rely on blockchain technology to manage their financial reserves. Think about it: a system that’s transparent, decentralized, and secure—capable of addressing many of the inefficiencies in today's financial systems, like sluggish transaction times, high fees, and a lack of transparency.

Read also:Deepwoken Hair Id Revolutionizing Hair Care With Ai

Blockchain, famous for powering cryptocurrencies like Bitcoin and Ethereum, brings unique features to the table—immutability, decentralization, and smart contracts—that could transform treasury operations. But as with any disruptive idea, Musk’s proposal has sparked plenty of questions. Can it really work? Is it safe? And how will regulators react? These are just a few of the concerns swirling around this bold initiative.

What Musk’s Proposal Aims to Achieve

At its core, Musk’s proposal sets out to tackle some of the biggest pain points in treasury management. Here’s what it hopes to accomplish:

- Boost transparency in financial transactions, making it easier to track where every dollar goes.

- Cut down on the costs associated with traditional banking systems, saving organizations millions—or even billions—of dollars.

- Enhance security by using advanced cryptographic protocols to protect sensitive financial data.

- Speed up cross-border transactions, making international payments faster and more efficient.

Elon Musk: A Quick Look at His Story

Elon Musk, born on June 28, 1971, in Pretoria, South Africa, is no stranger to big ideas. Known for his work as the CEO of companies like SpaceX, Tesla, and Neuralink, Musk has earned a reputation as a visionary leader in the tech world. His ability to think outside the box and tackle seemingly impossible challenges has made him one of the most talked-about figures of our time.

A Snapshot of Elon Musk’s Life

| Attribute | Details |

|---|---|

| Full Name | Elon Reeve Musk |

| Date of Birth | June 28, 1971 |

| Place of Birth | Pretoria, South Africa |

| Education | University of Pennsylvania (B.S. in Physics and Economics) |

| Companies Founded | SpaceX, Tesla, Neuralink, The Boring Company |

The Nitty-Gritty of the Proposal

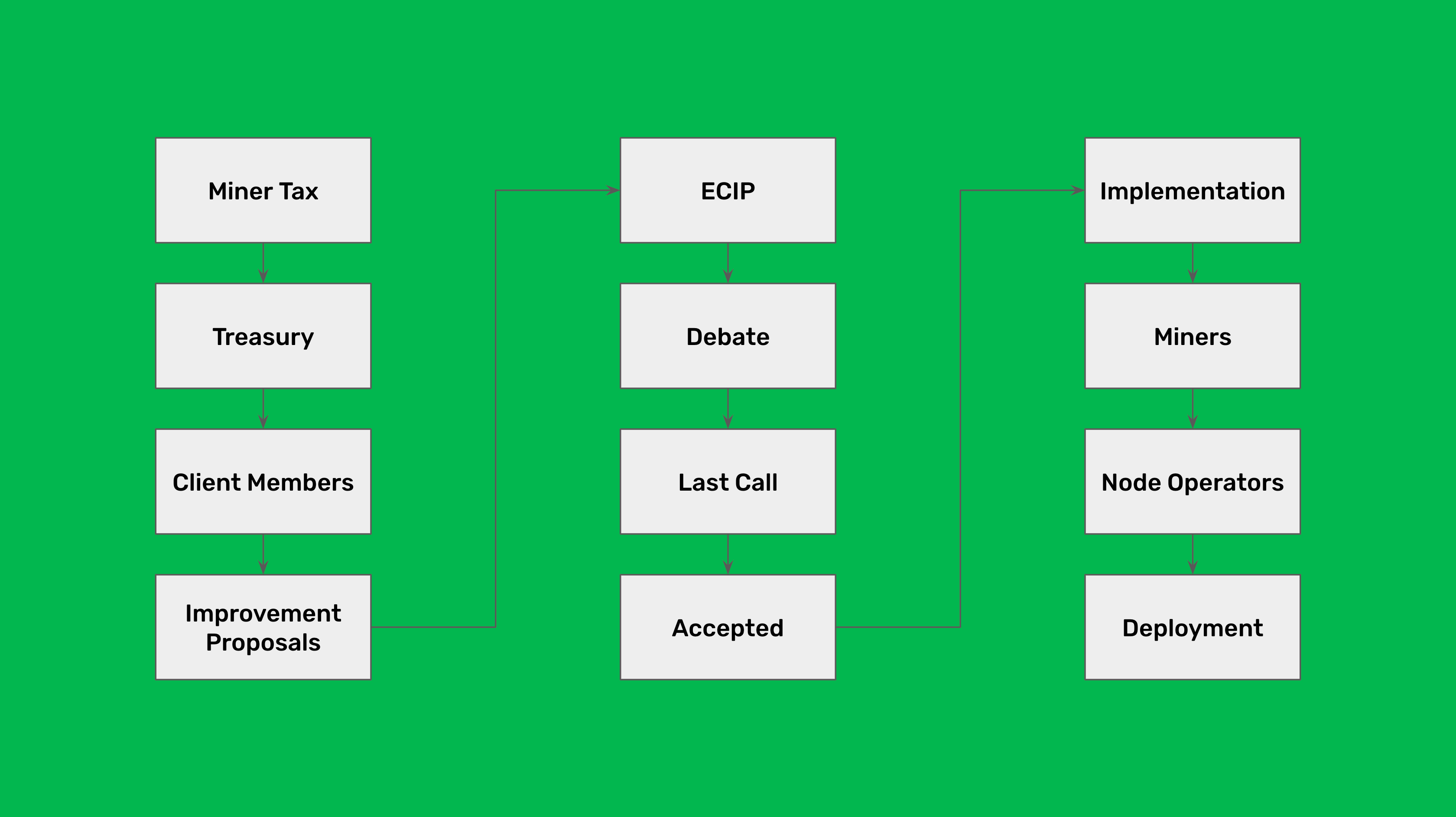

Musk’s blockchain treasury proposal outlines a system where blockchain serves as the backbone of financial reserve management. This system would leverage smart contracts to automate tasks like budget allocation, auditing, and compliance. By cutting out intermediaries, the proposal aims to reduce operational costs and boost efficiency. Imagine a world where financial processes are seamless, secure, and transparent—that’s the vision Musk is pushing for.

Of course, turning this vision into reality isn’t without its challenges. Ensuring that the system works seamlessly with existing financial infrastructure, addressing scalability issues, and staying compliant with regulations are just a few of the hurdles that need to be cleared. It’s not an easy task, but Musk’s track record suggests he’s not afraid of tough challenges.

What Critics Are Saying About the Plan

While Musk’s proposal has its supporters, it’s also faced a wave of criticism from experts and industry leaders. Some of the biggest concerns include:

Read also:Alexandre Grimaldi A Modern Visionary Carrying Monacorsquos Legacy Forward

- Complexity: Critics argue that integrating blockchain into treasury operations is a complex and resource-intensive process that could take years—or even decades—to fully implement.

- Security Risks: Although blockchain is secure by design, combining legacy systems with blockchain networks could open the door to new vulnerabilities.

- Regulatory Uncertainty: The lack of clear regulations governing blockchain technology creates a gray area that could hinder its adoption in critical financial systems.

A Closer Look at the Criticisms

One of the biggest worries among critics is the complexity of integrating blockchain with traditional financial systems. These systems are deeply rooted in the way we do business, and transitioning to a blockchain-based model would require careful planning, coordination, and possibly a complete overhaul of existing processes. Moreover, the risk of security breaches during the integration phase is a major concern. Imagine the chaos if sensitive financial data were compromised during the switch—talk about a worst-case scenario.

Regulatory Hurdles and Concerns

When it comes to treasury management, regulatory compliance is non-negotiable. But here’s the catch: governments and regulatory bodies around the world are still figuring out how to regulate blockchain effectively. This uncertainty creates a roadblock for initiatives like Musk’s proposal, which rely heavily on regulatory approval to succeed. And with blockchain being a global technology, harmonizing regulations across different countries is a massive challenge. It’s like trying to get everyone to agree on the rules of a game—no easy feat.

Why Blockchain Could Be a Game-Changer

Despite the criticisms, blockchain technology offers some serious advantages for treasury management:

- Transparency: Blockchain’s immutable ledger ensures that every transaction is recorded openly and can’t be tampered with, promoting trust and accountability.

- Efficiency: Smart contracts can automate many financial processes, reducing the need for manual intervention and speeding things up.

- Cost Savings: By cutting out intermediaries like banks, blockchain can significantly lower transaction costs, freeing up resources for other priorities.

Real-World Examples of Blockchain Success

Blockchain isn’t just a theoretical concept—it’s already making waves in various industries. For instance, the World Food Programme (WFP) uses blockchain to manage cash transfers to refugees, ensuring that aid is distributed transparently and efficiently. Companies like IBM and Maersk have also embraced blockchain for supply chain management, using it to improve tracking, reduce costs, and enhance overall efficiency. These examples show that blockchain has the potential to transform not just finance, but industries across the board.

Security and Privacy: What’s at Stake?

When it comes to implementing blockchain in treasury management, security and privacy are top priorities. While blockchain’s cryptographic protocols make it inherently secure, integrating legacy systems with blockchain networks can create vulnerabilities. Plus, there’s the issue of privacy—storing sensitive financial data on a public blockchain raises concerns about who has access to that information. To address these concerns, hybrid blockchain solutions that combine public and private networks are gaining traction. These solutions offer the best of both worlds, providing transparency and security while keeping sensitive data private.

How Far Have We Come with Blockchain in Finance?

The adoption of blockchain in the financial sector is growing steadily. According to a report by Deloitte, more than 53% of financial institutions are actively exploring blockchain solutions. This growing interest is driven by the potential benefits of blockchain, including improved efficiency, reduced costs, and enhanced security. However, widespread adoption is still being held back by challenges like regulatory uncertainty, technical complexity, and a lack of standardization. Overcoming these obstacles will be key to making blockchain a mainstream solution in treasury management.

Blockchain vs. Traditional Systems: Who Wins?

When you compare blockchain to traditional financial systems, it’s clear that blockchain has some serious advantages. Traditional systems often suffer from slow transaction times, high costs, and a lack of transparency. Blockchain addresses these issues by offering faster, cheaper, and more transparent transactions. However, traditional systems do have one big advantage—they’re well-established and widely accepted. Transitioning to blockchain would require significant changes to infrastructure and processes, which may not be feasible for all organizations. It’s a trade-off that each organization will need to carefully consider.

What Does the Future Hold?

The future of blockchain in treasury management depends on how well we can overcome the challenges associated with its implementation. As regulatory frameworks evolve and technology continues to advance, the adoption of blockchain is likely to increase. Musk’s proposal, though ambitious, highlights the transformative potential of blockchain to reshape financial systems. For organizations considering blockchain adoption, it’s crucial to weigh the pros and cons and work closely with regulators, industry experts, and tech providers to ensure a smooth transition.

Final Thoughts

Musk’s blockchain treasury proposal has sparked a lively debate among financial experts and tech enthusiasts. While the proposal offers exciting possibilities like increased transparency, efficiency, and cost savings, it also raises important questions about feasibility, security, and regulatory compliance. The future of blockchain in treasury management will depend on how well we can address these challenges and leverage the strengths of this innovative technology.

So, what do you think? Is blockchain the future of treasury management, or is it just another buzzword? We’d love to hear your thoughts in the comments below. And if you’re hungry for more insights on blockchain and its applications, feel free to explore other articles on our site. Let’s keep the conversation going!